Gov’t borrows P30-B via T-bonds at higher rate

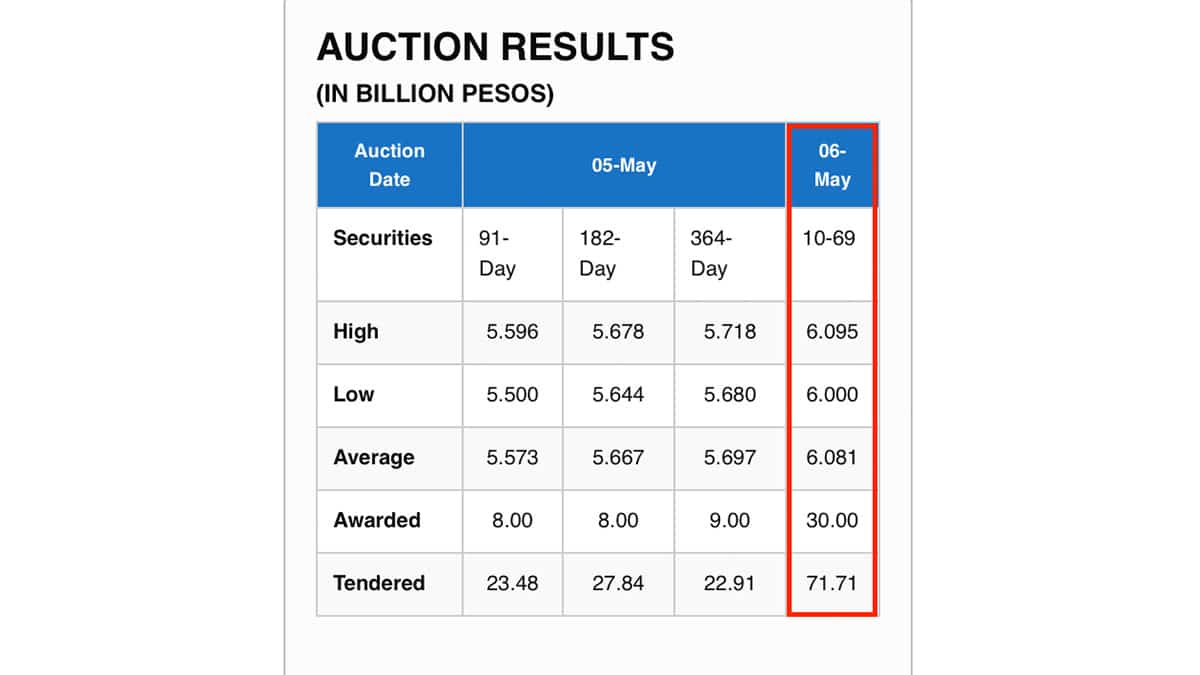

Auction results showed the Bureau of the Treasury (BTr) raised P30 billion via re-issued T-bonds, which have a remaining life of seven years and four months.

There was excess demand for the offering. The BTr said the T-bonds attracted total bids amounting to P71.7 billion, exceeding the original size of the issuance by 2.4 times.

READ: Philippine Treasury raises P300B from 10-year notes

But that did not stop local creditors from asking for higher rates.

The debt paper fetched an average rate of 6.081 percent, higher than the 5.986 percent seen in the previous auction of seven-year T-bonds nearly a month ago.

At the same time, the yield was higher than the 6.061 percent quoted for the comparable tenor in the secondary market as of May 5.

“The seven-year Treasury bond average auction yield was slightly higher after the recent P300 billion 10-year local Treasury note issuance siphoned off some of the excess peso liquidity from the financial system,” Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said.

For this year, the Marcos administration is targeting to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.

By sources of financing, the government will borrow P507.41 billion from foreign investors in 2025. The remaining P2.04 trillion is targeted to be raised domestically, of which P60 billion will be via short-dated Treasury bills and P1.98 trillion via T-bonds.